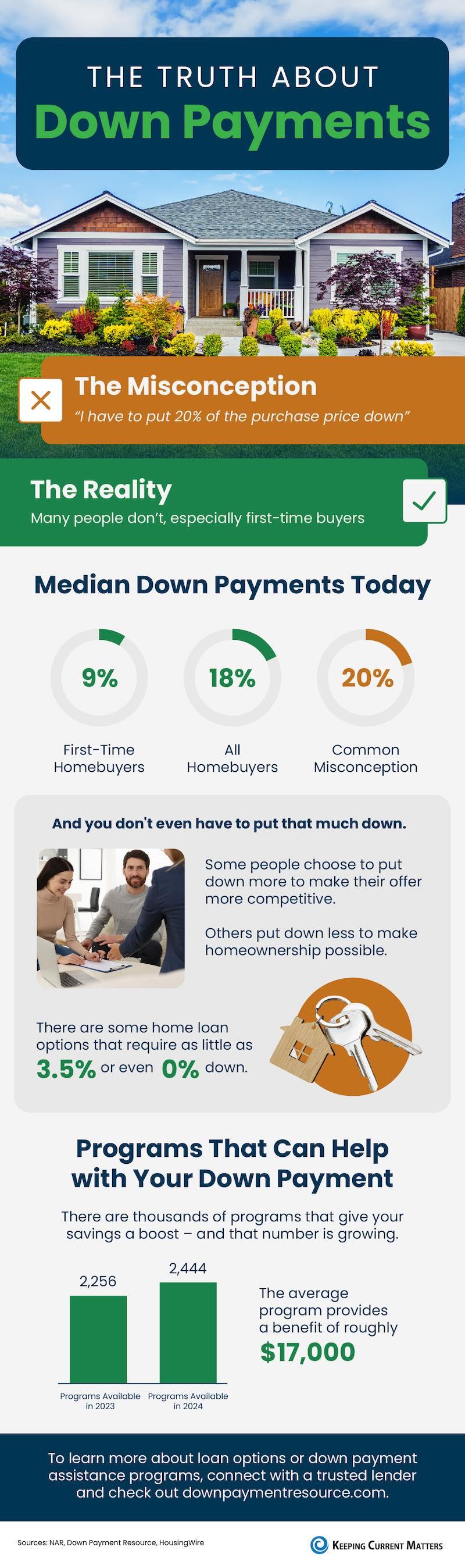

Many homebuyers mistakenly believe they need a 20% down payment to purchase a home—but that’s not the case! In reality, most buyers put down much less unless they’re trying to make their offer more competitive. Check out this handy infographic and tips for buyers below!

Tips for Buyers:

- Explore Down Payment Options: Look into low-down-payment loan programs, such as FHA or VA loans, which allow for smaller initial payments.

- Take Advantage of Assistance Programs: Many down payment assistance programs can help cover a portion of your upfront costs, with an average benefit of nearly $17,000.

- Boost Your Savings: Plan by setting aside savings for a down payment, closing costs, and additional expenses.

Ready to explore your options? Did you know that the Kansas City region has NUMEROUS down payment assistance programs? Call Merla at 816-328-2887 for information and referrals to local, trusted lenders specializing in helping people realize the dream of homeownership!