If you’ve been paying attention to the housing market, you’ve probably seen some shifts lately. The market isn’t nearly as wild as it was during the pandemic, but it's not crashing either. So what does that mean for you if you're thinking about buying or selling a home in Lee’s Summit?

Let’s break it down using the latest expert projections and look at what to expect for the rest of 2025.

Are Home Prices Going to Drop?

Let’s get this out of the way first. Everyone wants a deal. But waiting around for home prices to take a nosedive? That’s probably not going to happen.

What the Experts Say:

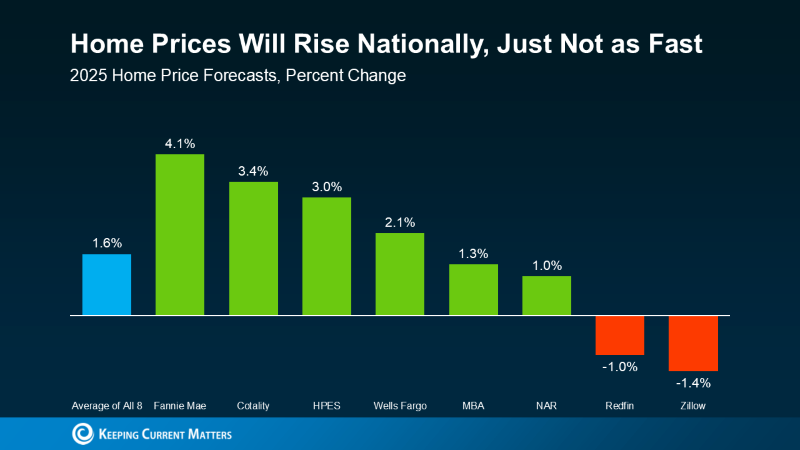

The average forecast from eight leading housing authorities shows a 1.6% increase in national home prices for 2025. Fannie Mae is even more optimistic, predicting a 4.1% rise. Only Redfin and Zillow expect small dips around 1%, but they’re outliers.

This isn’t a bubble about to burst. It’s a market settling back into a more balanced state.

“House price growth slowed... but prices will still rise this year at the national level.” – National Association of Home Builders.

Now zoom in on Lee’s Summit. Our market consistently outperforms the national average. Award-winning schools, community amenities, and desirable neighborhoods, such as Winterset, Raintree, Lakewood, and numerous others, help maintain steady demand. So if the country is looking at a 1–2% gain, we could easily see 3–4% growth locally.

What About All Those “Prices Are Dropping” Headlines?

Yes, a few cities are seeing tiny price corrections, but we’re talking about average dips of just 3.5%. That’s nothing compared to the 20% crash back in 2008.

And don’t forget—home values are still up 55% nationally compared to five years ago. So even if prices cool off slightly in a few places, homeowners are still way ahead.

Are Mortgage Rates Going to Drop?

Many buyers are holding out for rates to fall. The bad news? That magical drop probably isn’t coming anytime soon.

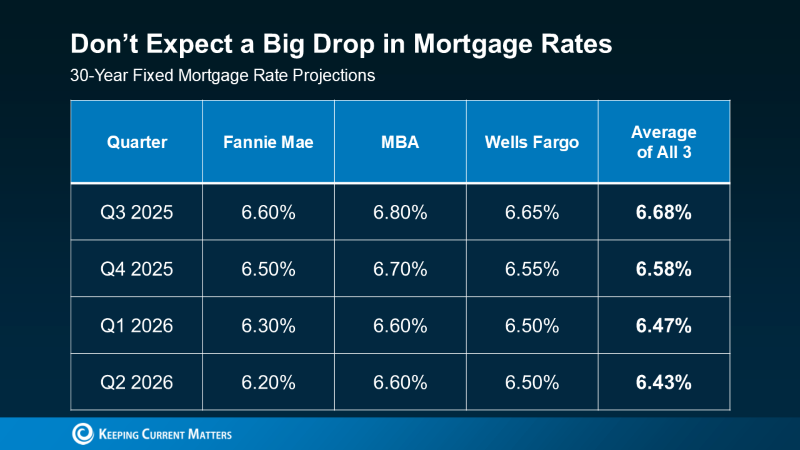

According to projections from Fannie Mae, the Mortgage Bankers Association, and Wells Fargo, mortgage rates are expected to trend downward slowly, but not by much.

So yes, rates may ease up a little, but we’re still talking about mid-6% territory. Not a game-changing difference.

“If you’re looking for a substantial interest rate drop in 2025, you’ll likely be left waiting.” – Yahoo Finance.

Why Waiting Might Cost You

Let’s say you’re eyeing a $400,000 home today. If prices increase by 3% next year, the same home could cost $412,000. Even if your mortgage rate drops slightly, the higher price could wipe out any savings.

Additionally, as more buyers return when rates drop, competition and sparking bidding wars pick up again.

What Buyers Should Be Doing Right Now

If you're ready to buy and your finances are solid, don’t wait around for the “perfect time.” That time might never come.

Quick Tips for Buyers:

- Get pre-approved so you know your budget and can act fast.

- Focus on the right home, not the perfect rate. You can always refinance later.

- Partner with a local agent (that’s me!) who knows how to navigate this kind of market.

What Sellers Need to Know

You haven’t missed your moment. With inventory still low in many parts of Lee’s Summit, homes that are priced correctly and effectively marketed continue to draw strong interest and sell extremely quickly.

Quick Tips for Sellers:

- Prep your home to shine. Buyers want move-in ready.

- Lean into marketing that highlights what makes your home stand out.

- If you’re selling and buying at the same time, let’s talk strategy to avoid getting stuck between moves.

So, What’s the Bottom Line?

This isn’t a market meltdown. It’s a return to something more normal. Prices are still rising, and rates are currently hovering around 6.5%. If you're waiting for significant changes, you might be waiting a while.

Focus on your goals, your timeline, and your finances. Don’t let the headlines make your decision for you.

Thinking About Buying or Selling in Lee’s Summit?

Let’s sit down, map out your options, and make a plan that works for you. Give me a call or text at 816-328-2887 today!