Let's talk about something most people don't check nearly as often as their bank account—your home's value. And yet, for many homeowners in the Kansas City area, your house is probably the most significant financial asset you own. If you've lived there for a few years (or longer), chances are it's been quietly growing your wealth in the background.

And here's the kicker—you might be sitting on way more than you think.

What Is Home Equity, Really?

Home equity is basically your hidden net worth. It's the difference between what your home is worth and what you still owe on your mortgage. Home values rise (which they've done a lot in Missouri lately), and your equity builds as you chip away at your mortgage.

For example, say your home's current value is $500,000, and your mortgage balance is $200,000. That's $300,000 in equity—money you could potentially tap into.

And you're not alone. According to Cotality (formerly CoreLogic), the average homeowner with a mortgage is sitting on $311,000 in equity.

Why You Might Have More Than You Think

There are two big reasons homeowners in Missouri—and especially around Lee's Summit and Kansas City—are seeing their equity skyrocket:

1. Massive Home Price Growth

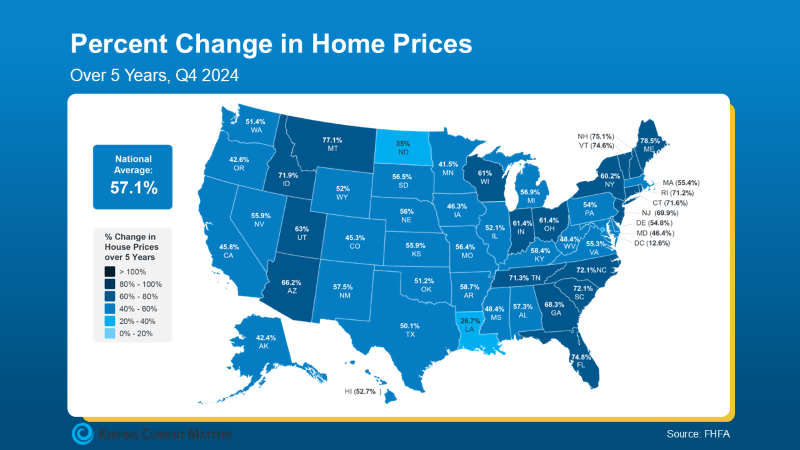

According to the Federal Housing Financing Agency, home prices in Missouri are up 56.4% over the last 5 years. Nationally, the average increase is 57.1%, but even just being close to that number means major equity gains. If you bought your home before or around 2019, you've likely built a serious chunk of wealth just by living there.

2. People Are Staying Put Longer

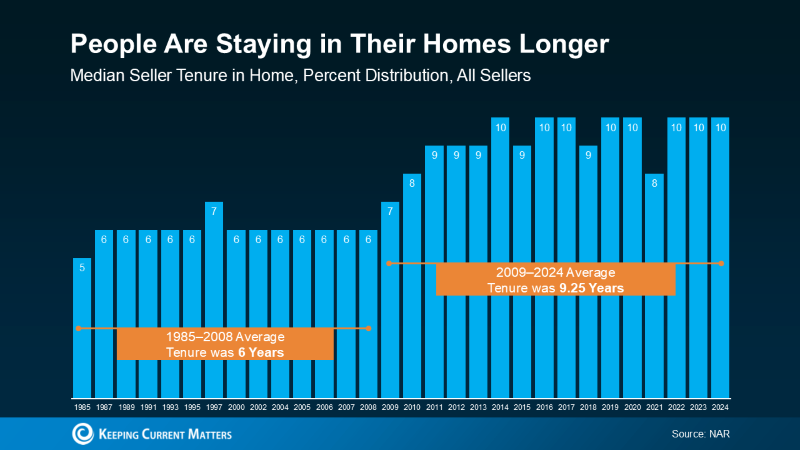

Homeowners aren't moving every 5-6 years like they used to. According to the National Association of Realtors, the average tenure is 10 years—the longest in decades.

That means many homeowners have built up equity slowly and steadily by making monthly payments and letting appreciation do its thing. In fact, NAR reports that the typical homeowner gained $201,600 in wealth just from price appreciation over the past decade. That's real money.

What Can You Do With That Equity?

Equity isn't just a number on paper—it's a financial tool. In today's market, it could be your ticket to something bigger, better, or more aligned with your life.

Here are a few smart ways to use it:

- Buy your next home – Use your equity for a down payment, or even buy your next place in cash (yes, it happens).

- Renovate and upgrade – Make your current home fit your life better. Add a new kitchen, finish the basement, or build that dreamy outdoor space.

- Launch a business or side hustle – If you've been thinking about chasing that dream, your equity could help with startup costs and breathing room.

Bottom Line

Most people seriously underestimate what their home is worth—especially in areas like Lee's Summit, Raymore, Blue Springs, and the rest of KC. If you've been in your house for even just five years, you could be sitting on life-changing equity.

So, let me ask you: If you sold your home and walked away with a big pile of equity—what would you do with it?

Let's find out what your home is really worth and explore your options together. No pressure. It's just a smart move.

Text or call me at 816-328-2887, and let's talk strategy.