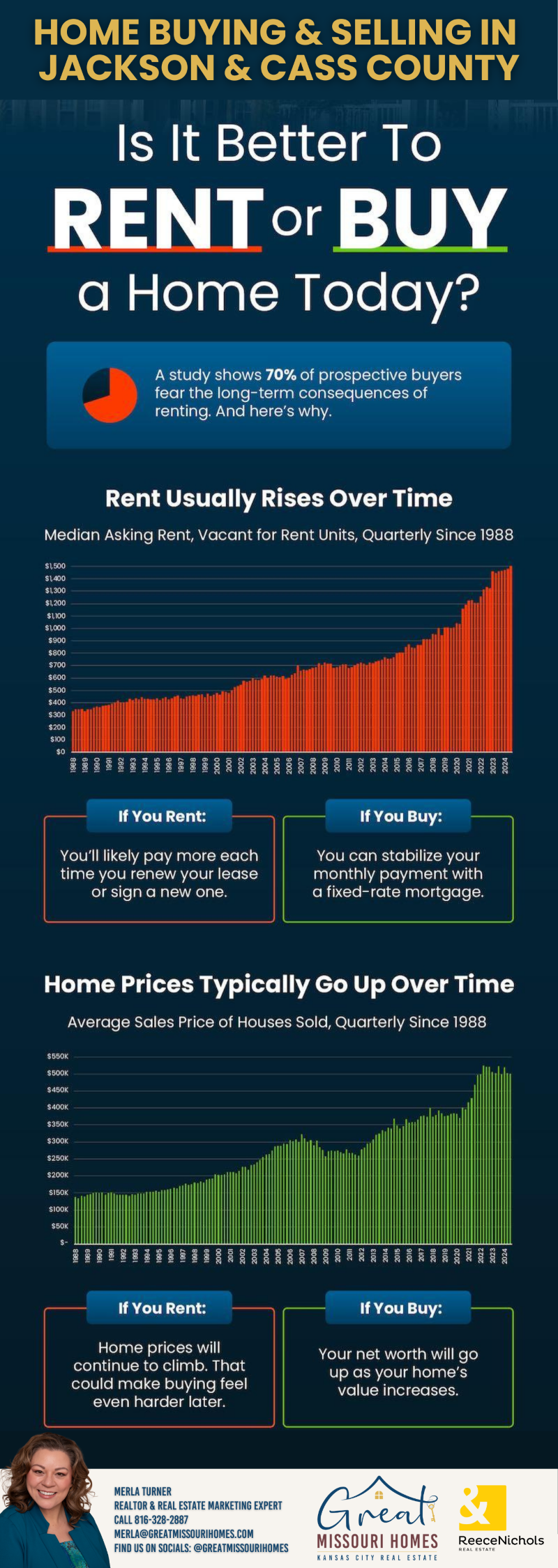

If you’re renting a home or apartment in Kansas City, you’ve probably had this thought at least once: “Should I just buy a house instead?” You’re not alone. In fact, studies show that 70% of people who are thinking about buying worry about what happens if they keep renting forever.

So, let’s break it down. What’s the better move — renting or buying? Spoiler alert: Buying usually wins in the long run, especially if you want to build wealth instead of just watching your rent check disappear every month.

Rent in Kansas City: It’s Not Getting Cheaper

Let’s be real — rent rarely goes down. Data from the St. Louis Fed shows that rents across the U.S. (including Kansas City) have been rising steadily for decades. Every time you renew your lease, there’s a good chance your rent is creeping up. And if you’re moving to a new place? Even higher rent is waiting for you.

Why does this matter? Well, rent is one of those expenses you can’t control. Your landlord calls the shots. And when the market heats up (which it has), renters feel the squeeze.

Home Prices Go Up Too — But That Can Actually Be Good News

On the flip side, home prices have also been climbing over the years. But here’s the difference: When you own the home, that price increase works in your favor. That extra value becomes equity — aka your personal slice of wealth.

With a fixed-rate mortgage, your monthly payment stays the same, even if home prices keep climbing. No rent hikes, no surprise increases – just predictable payments and long-term financial gain.

Renting vs. Buying — Let’s Sum It Up

IF YOU RENT |

IF YOU BUY |

|---|---|

| Your rent keeps going up. | Your mortgage stays the same (with a fixed-rate loan). |

| You build zero equity – your rent helps your landlord, not you. | Every payment helps you build equity in your own home. |

| Home prices get further out of reach. | You benefit from rising home values. |

What Does This Mean for Kansas City Renters?

Kansas City’s housing market has seen steady growth, and home prices have been climbing over the past several years. If you’re renting now and hoping prices will magically drop, you could be waiting a long time. And by then? Homes will likely be even more expensive.

That’s why many renters are shifting gears and becoming homeowners sooner rather than later. They’re locking in stable payments, grabbing a piece of Kansas City’s growing home values, and saying goodbye to unpredictable rent hikes.

Quick Tip: Think Long Term

Sure, buying a home comes with some upfront costs and maintenance, but when you spread those costs over the years, you’ll own the home (and consider how much equity you’ll build); it’s usually a win.

Plus, buying a home isn’t just about the money. It’s about putting down roots, personalizing your space, and creating stability — things renting can’t always offer.

Ready to Explore Your Options?

Let’s chat if you’re tired of rent increases and wondering whether it’s time to become a homeowner in the Kansas City area. I’m here to break down your options, answer your questions, and help you determine if buying makes sense right now.