Owning a home is a big milestone, and homeowner’s insurance is your safety net—protecting what’s likely your biggest investment. While you never want to imagine worst-case scenarios, the right coverage ensures you’re prepared if something goes wrong.

Why Homeowner’s Insurance Matters

Here’s what a solid homeowner’s policy does for you:

- Covers Repairs and Rebuilding Costs – If your home is damaged by fire, storms, or other covered disasters, your insurance helps pay for repairs or sometimes a complete rebuild.

- Protects Your Belongings – Many policies also cover personal items like furniture, electronics, and clothing if they’re stolen or damaged.

- Provides Liability Coverage – If someone gets injured on your property, your insurance can help cover medical bills or legal expenses.

At the end of the day, it’s all about peace of mind—knowing that if something unexpected happens, you’re not stuck footing the entire bill.

Rising Costs: What Kansas City Homeowners Should Expect

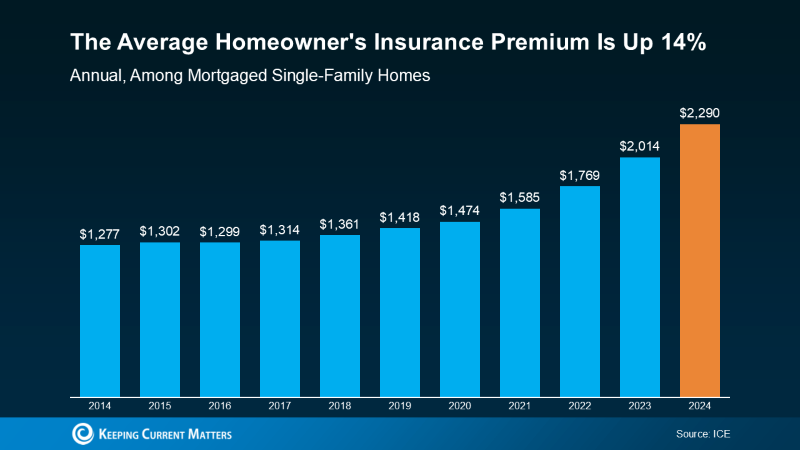

The price of homeowner’s insurance is climbing—and it’s not just a slight increase. Data from ICE Mortgage Technology shows that the average annual premium for a mortgaged home has nearly doubled since 2014, jumping from $1,277 to $2,290 in 2024. That’s a 79% increase in just 10 years!

So, what’s driving these costs up? Four major factors:

- More severe weather events (like hailstorms, tornadoes, and wildfires) are leading to higher claim payouts.

- Insurance companies are pulling out of certain areas, reducing competition and driving up rates.

- Claims are rising faster than past rate increases, forcing insurers to adjust pricing.

- The cost of materials and labor has surged, making repairs and rebuilds more expensive.

Throughout the nation, homeowners are experiencing these effects firsthand. Storm damage claims are common, and rebuilding costs have skyrocketed with recent inflation.

Higher Landlord Costs = Higher Rents

If you’re a renter in the Kansas City area, this affects you, too. When landlords’ insurance and property taxes go up, they pass these costs onto tenants through higher rent prices.

Data backs this up:

- A 10% increase in property taxes typically results in a 1-3% rise in rent (Urban Institute).

- Rising homeowner insurance premiums have been linked to 6-10% rent increases in high-cost areas.

- With mortgage rates already pushing home prices up, rental demand remains high—giving landlords more flexibility to raise rents.

How to Keep Your Insurance Costs Down

While you can’t control the insurance market, there are smart moves you can make to lower your homeowner’s insurance bill:

Shop Around: Rates vary widely by provider, so don’t settle on the first quote you get.

Bundle Your Policies: Many companies offer discounts if you bundle home, auto, and life insurance.

Upgrade Your Security: Adding a home security system, fire alarms, or impact-resistant roofing could earn you discounts.

Raise Your Deductible: A higher deductible can mean lower monthly premiums if you can afford a higher out-of-pocket cost in the event of a claim,

Bottom Line

When budgeting for homeownership, don’t just focus on the mortgage payment—factor in homeowner’s insurance too. Yes, prices are rising, but the right policy protects your home, your belongings, and your financial future. What’s your biggest concern about homeowner’s insurance? Let’s talk! I can connect you with local trusted insurance resources and strategies to keep your homeownership costs in check.