Suppose you’re thinking about buying a home in Kansas City, Lee’s Summit, or anywhere in the metro area. In that case, one step you absolutely should take before you start scrolling through listings online is to get pre-approved for a mortgage.

Skipping this step is like walking into a car dealership without knowing your budget—you might fall in love with something way out of your price range or, worse, miss out on a home because another buyer was more prepared. Let’s break down why pre-approval matters and how it can help you land your dream home in today’s market.

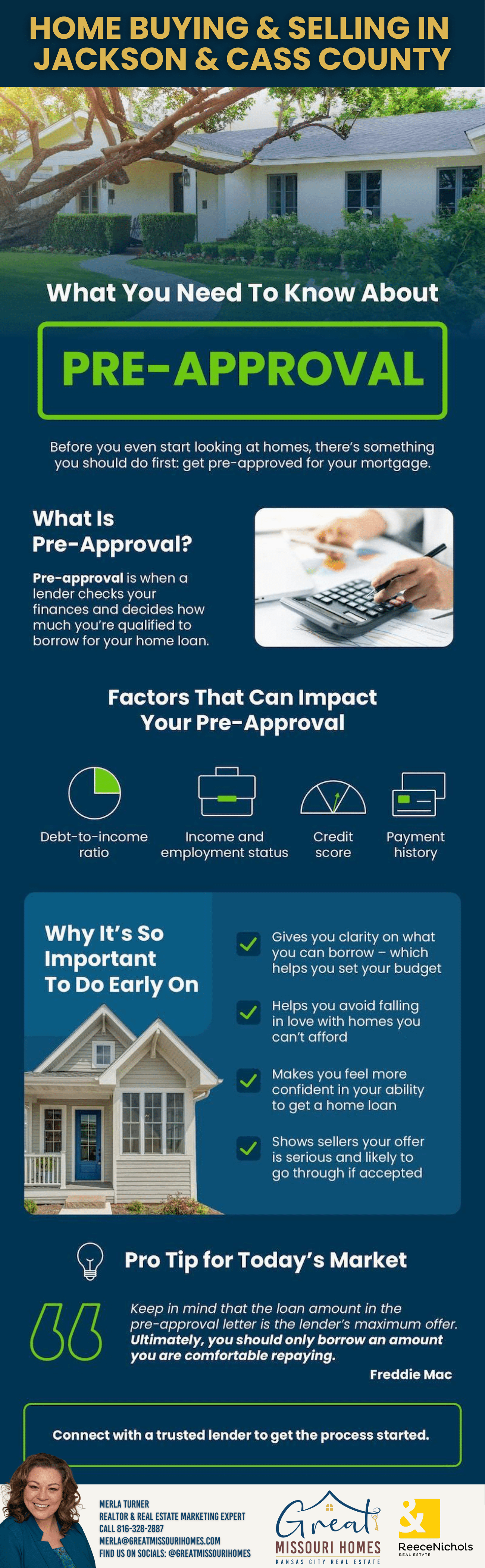

What is Pre-Approval?

Pre-approval is when a lender looks closely at your finances—your income, debt, credit score, and payment history—to determine how much they’re willing to lend you for a home purchase. Think of it as your home-buying permission slip. It tells sellers (and real estate agents) that you’re financially ready to make an offer.

Why It’s So Important to Get Pre-Approved Early

The Kansas City housing market, including areas like Lee’s Summit, Raymore, and Overland Park, has been competitive in recent years. Homes priced well and in good condition move fast, and buyers who come prepared have a major advantage. Here’s why pre-approval should be your first step:

You’ll Know Your Budget

A pre-approval tells you how much home you can afford, so you don’t waste time looking at properties outside your price range.

Pre-Approval Helps You Avoid Heartbreak

Nothing stings quite like falling in love with a house only to realize later that it’s out of reach financially. Pre-approval keeps you focused on homes that match your budget.

You’ll Be a Competitive Buyer

Sellers in hot markets like Kansas City and Lee’s Summit prioritize offers from pre-approved buyers. This is basically a requirement for writing an offer on a home—sellers don’t entertain offers from people who cannot back up their ability to close on the property.

Being Pre-Approved Gives You Confidence

Buying a home is a big deal, and knowing your loan is already in the works makes the process less stressful. You won’t be scrambling at the last minute to secure financing.

The Importance of a Trusted Mortgage Lender

Not all lenders are created equal. The right mortgage lender or advisor will do more than just crunch numbers—they’ll help you navigate loan options, find the best interest rates, and ensure you’re making the smartest financial decision for your future. A great lender will communicate clearly, answer all your questions, and keep the process moving smoothly.

If you’re unsure where to start, I have strong relationships with numerous trusted local lenders who can help guide you through the pre-approval process. Whether you’re a first-time homebuyer or upgrading to your dream home, I can connect you with someone who will make sure you’re getting the best deal possible.

What Affects Your Pre-Approval?

Lenders consider several factors when determining your loan amount:

- Debt-to-Income Ratio – How much debt you have compared to your income.

- Income & Employment Status – Your job history and stability matter.

- Credit Score – Higher scores often mean better loan terms and lower interest rates.

- Payment History – Late payments can hurt your chances of approval.

If your credit score needs work or your debt is too high, your lender can give you tips on improving your financial standing before making an offer on a home.

Pro Tip: Only Borrow What You’re Comfortable With

Your pre-approval letter will show the maximum amount a lender is willing to give you—but that doesn’t mean you should spend every penny. Consider your lifestyle, future plans, and emergency savings before committing to a mortgage amount. Just because you qualify for a $500,000 loan doesn’t mean you should buy a $500,000 home.

Ready to Get Pre-Approved? Let’s Connect

If buying a home in Kansas City, Lee’s Summit, Raymore, or the surrounding areas is on your radar, don’t wait to get pre-approved. It’s the best way to set yourself up for success and get ahead of the competition. I work with trusted local lenders who can help you navigate the process and secure the best rates.

Let’s talk about your homeownership goals and get you started on the right foot. Call or text me today at 816-328-2887!